Research & Blogs

CoinRoutes 1st Half Performance Review

Dave Weisberger

July 19, 2024

The first half of 2024 is complete, with CoinRoutes clients trading over $85 Billion in notional value using our platform. The key finding is, our clients using the CoinRoutes SmartPost algorithm, achieved lower trading costs than would be expected for a traditional market access platform. In this report, we focus on the slippage versus the Best Bid or Offer at the time the order was received as the key metric, as that is comparable to what is used in other asset classes. By that metric, for institutional sized orders, we found CoinRoutes clients were able to execute, in the crypto spot and derivative markets, at a substantially lower aggregate cost than comparable orders in the equity markets.

We also measured our algorithm’s slippage against the Volume Weighted Average Price during the time the order was active, which, for institutional sized orders, was statistically zero¹. That shows, despite paying the exchange fees, our algorithms were able to minimize those fees while also capturing some of the bid/offer spread.

Overall, the performance was excellent across the board for both spot and derivative products.

Introduction & Methodology

To conduct this analysis, we included all client orders using our base algorithmic suite and excluded constrained orders², those that were significant outliers³, both good and bad, as well as orders submitted during periods of market data disruptions⁴ from exchanges. All orders were time stamped by the client server and the market data used for the calculations were collected from the exchanges selected by the client at the time of order entry.

For the purpose of this report, we compared the net execution price to the displayed mid and far price from the client selected exchanges to calculate slippage. Mid price is self explanatory, being the average of the best bid and best offer at the time the order was first sent. Far side, however, is the higher of the bid or offer at that time for a buy order and the lower if a sell. This was done to approximate the standard bid offer spread, even in cases where the market was crossed⁵.

The report will show summary statistics for product type (spot and perpetual swap) as well as breaking out specific, high-volume pairs, but we also analyzed two specific order sizes. First, we analyzed “institutional” orders which are defined in traditional finance to be those over $200,000 in notional value. In the case of those orders at CoinRoutes, using a $200k minimum size yields a dataset of orders where the average size is roughly $2 million per order, which is quite consistent with institutional orders in the equity market. Second, we broke out orders ranging from $20,000 to $200,000 as those are highly representative of the orders sent by systematic trading clients as opposed to retail aggregators.

CoinRoutes' Aggregate Performance vs Chosen Benchmarks

We chose the slippage metrics in order to be comparable to the equity market, where the assets are relatively idiosyncratic, traded by a combination of order books, electronic dealer quotes and OTC and have significant variance in bid offer spreads⁶. In that market, the two most used benchmarks are labeled implementation shortfall, which is the slippage vs the last trade or mid price and the slippage vs the Volume Weighted Average Price (VWAP).

There is one major difference between the crypto markets and the equity markets worth noting: crypto exchanges charge access fees that are many multiples of the quoted tick size. For example, at one of the best tier rates at Binance, the charge to take liquidity is three basis points. For Bitcoin, that take fee represents roughly $19 at current prices while the tick size is one cent. As a result, it would be reasonable to expect that crypto market execution performance, net of exchange fees, would be worse than in equity markets, where the access fees are capped at a fraction of the bid offer spread. That, however, was not the case.

According to a recent analysis by Bloomberg research⁷, “In our BTCA Peer Benchmark... we observed an average slippage of minus 16.9 bps in the most volatile equities”. As all crypto assets would be categorized as in the more volatile of equity assets, we believe the 16.9 basis points to be a fair comparison. Across all spot orders at CoinRoutes, however, we noted slippage from the mid of roughly 10.4 basis points, net of execution fees paid to exchanges. When we narrow the focus to Institutional orders only, the slippage only rose to 10.94 basis points across almost $10 billion in notional value traded. That will be discussed in more detail in the next section.

SPOT%20Metrics%20(ALL%20order%20sizes).png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2FErT8FrJXh1pU4gX3o2eUh%2Fc8558fccb20ae383a045f6274dd972ae%2F5_SPOT_Metrics__ALL_order_sizes_.png)

Referring back to the Bloomberg report cited earlier, that means that CoinRoutes clients, trading institutional sized orders in spot crypto, experienced almost 50% lower slippage than the average institutional equity trader in high volatility assets.

While we did not find a good source of comparable statistics for derivatives, we also evaluated the aggregated client trading in Perpetual Swaps. Unsurprisingly, considering the higher liquidity, albeit with wider spreads, and smaller order sizes, the aggregate slippage from the midpoint for all orders through CoinRoutes was 6.5 basis points, net of fees. This was on almost $34 Billion in orders executed through the system.

%20PERP%20Metrics%20(ALL%20order%20sizes).png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F1Ixvho6KucaiAfY0FJ5jB4%2F701998caec2fbc254e497de0b3f41d6d%2F6__PERP_Metrics__ALL_order_sizes_.png)

Performance by Order Size & Product

As shown above for spot products, we analyzed orders based on order size to attempt to understand the impact of larger trades. In addition to the “all sizes” analysis, we broke the universe into orders over $20,000 but no greater than $200,000 as that size is most representative of our systematic trading clients. We also analyzed orders over $200,000 as that is the definition of institutional order size used in legacy financial markets⁸.

Institutional Large Order Size Analysis:

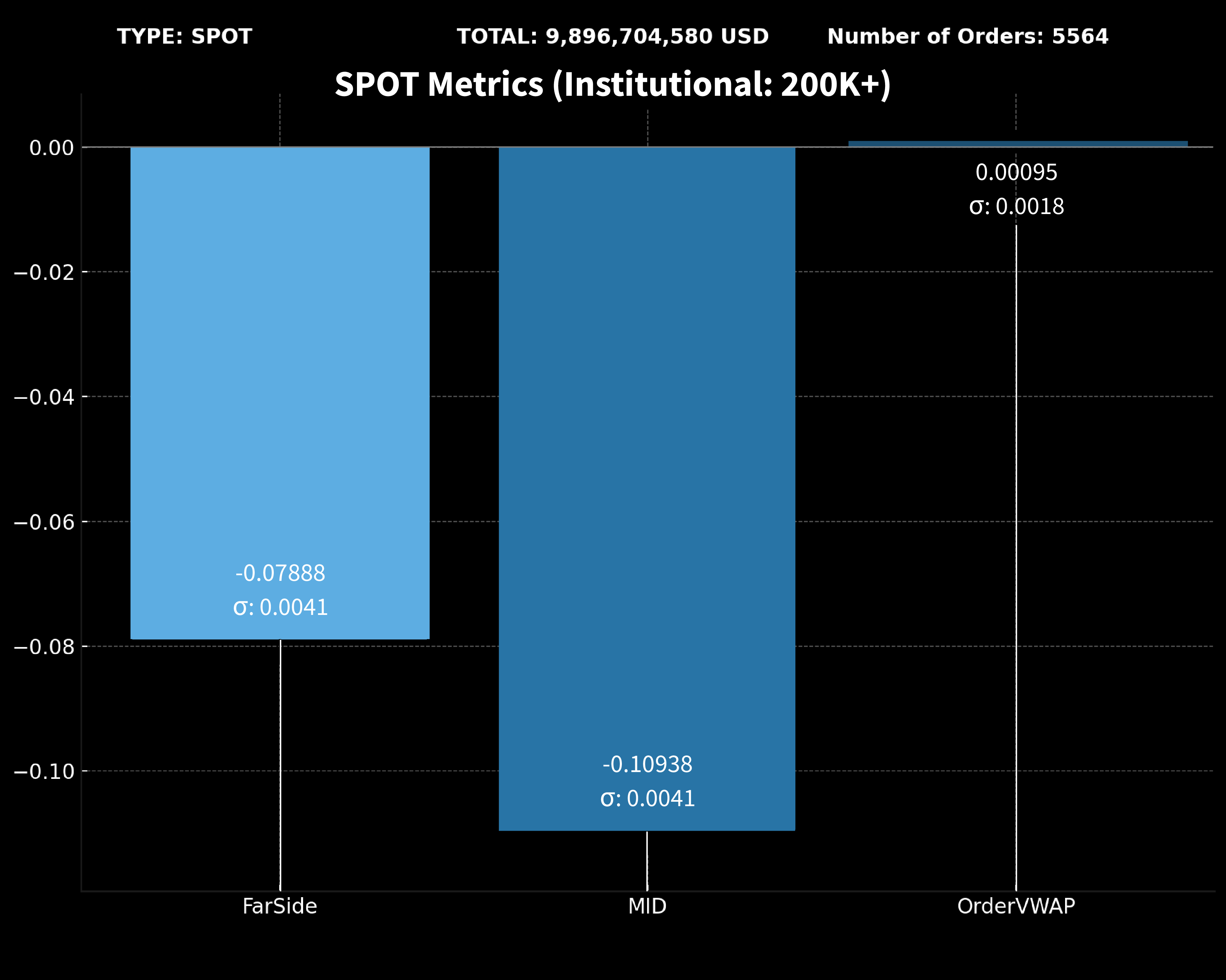

As mentioned above, on institutional orders in SPOT products, which includes Bitcoin, Ether, Solana and others priced in fiat currencies or stablecoins, the aggregate slippage vs the midpoint was 10.95 basis points for almost $10 Billion in such orders in the first half. The average order size for these orders was over $1.75 million per order as can be seen in the following graphic.

It is interesting that the graphic also shows the performance, even though it includes the exchange fees paid, was infinitesimally better than the Volume Weighted Average Price (VWAP) for the period the order was traded. Considering the lowest exchange fee for any market for our clients was over a full basis point and most are over two, this is indicative of significant spread capture and cost savings.

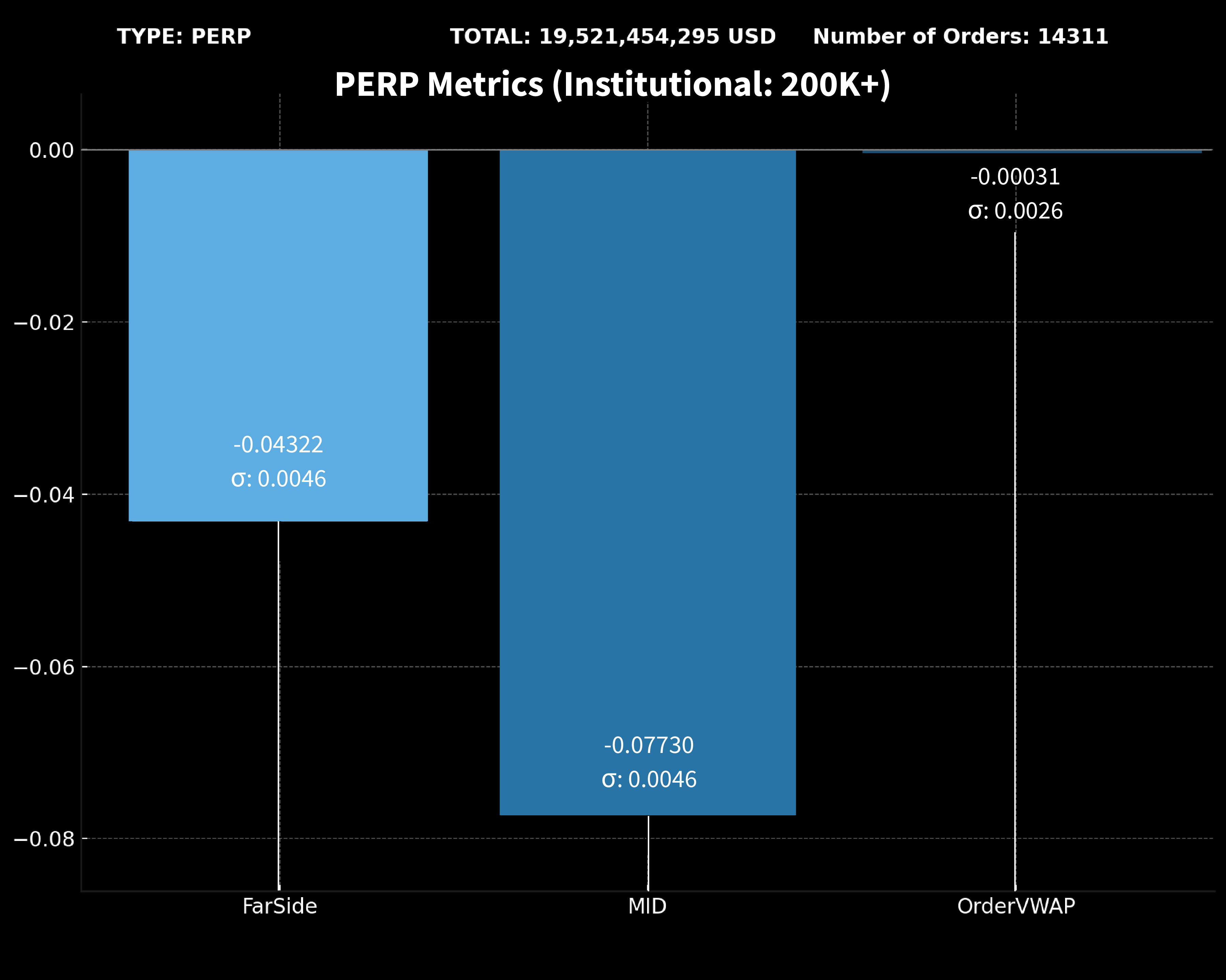

The performance on Perpetual Swaps was also quite constructive during the period. On over $19.5 Billion of one sided swap orders⁹, CoinRoutes clients experienced only 7.7 basis points of slippage vs the midpoint price of the swap, net of fees. For this set of orders, the average order size was roughly $1.36 million, which is somewhat smaller than the spot dataset, potentially explaining the smaller cost.

As with spot, the performance vs the VWAP during the order duration was also accomplished with almost no slippage. The number of a fraction of a basis point of slippage is well within statistical error. As a result, we conclude that the CoinRoutes algorithm is capturing a part of the bid offer spread in addition to saving on exchange fees.

Institutional Systematic Order size analysis:

We next analyzed slippage for orders that ranged between $20,000 and $200,000 for both Spot and Derivative products. As can be seen in the graphic below, on over $1 billion of notional value traded the average slippage versus the midpoint was 6.2 basis points. It is interesting that the slippage vs the far side was only 3.6 basis points, indicating, for that dataset, wider spreads than in the larger sized orders which makes the 6.2 basis points of slippage more impressive. The performance vs the order VWAP was statistically positive, but, since these orders were shorter in duration than the larger ones and the trade data can be somewhat lagging, it is possible it is an overestimation. That said, it is quite clear that the algorithm performed much better than taking liquidity exclusively.

SPOT%20Metrics%20(20K-200K).png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F2uZp6yQ1jitJibNMu5FpAs%2F190676a39673bc01dc1501027402dc1a%2F1_SPOT_Metrics__20K-200K_.png)

Analysis of perpetual swap orders showed that for $6.6 billion in notional value traded, the slippage vs the midpoint was 5.1 basis points, while the slippage vs the far side was only 2.7 basis points. As with spot, the data showed outperformance vs the order VWAP with the same caveats.

PERP%20Metrics%20(20K-200K).png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F36Q2X3JYluYfALHOngvlh5%2F6398db0ed1334e945b060d54cd53cd14%2F2_PERP_Metrics__20K-200K_.png)

Performance on Bitcoin, Ether and Solana Pairs

In this section, we show performance metrics vs some of the most liquid spot and derivative pairs. We break out US Dollar denominated pairs from USDT (Tether) pairs and analyze USDT based derivatives, as they are the most liquid. For the purpose of this analysis, we chose to include all orders greater than $20,000, as it represents institutional trading from systematic through to block trading.

Bitcoin Performance

Bitcoin trading in the first half was dominated by flows related to the Bitcoin ETF, including arbitrage opportunities related to USD denominated trading. While this analysis is focused on our unconstrained SmartPost algorithm, it is worth noting that over $15 billion in spread algorithm trading, where one asset is purchased and another is sold at the same time, was also executed through the platform.

The first chart shows the performance of Bitcoin traded vs USDT. There were over $500 million in notional value traded with an average order size of roughly $270k. Bitcoin, as the most liquid instrument, was traded through the CoinRoutes platform at an average slippage vs the midpoint of under 2.8 basis points. At the same time, the slippage vs the far side was well below 1 basis point.

BTC-USDT.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F7awfqXlW0ycLNvRDJwV8OD%2F1af23ee4d1befd028c7ca83434ba5577%2F8_BTC-USDT.png)

The next chart shows the performance of CoinRoutes algorithms for orders in Bitcoin in US Dollars. Over the first half, this represented over $6.1 billion in notional value, but only 3012 orders, for an average order size of over $2 million. Thus, it is not surprising that the results closely approximate the aggregate spot trading numbers shown above. The slippage on these orders was under 8.5 basis points vs the midpoint and under 5.5 basis points versus the far side.

BTC-USD.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F3U8F2G9JUgM1d3ISTmySby%2Fdb1ffbf2fa17272f7d0ab5a62f9e6269%2F7_BTC-USD.png)

Lastly, we show the performance of Bitcoin Perpetual Swaps. This represented $13 billion in notional value traded over more than 28,000 orders (average order size of $464k). Interestingly, while the slippage vs the Midpoint was roughly 5.6 basis points, slippage vs the far side was under 2.3 basis points. Effectively, that means that CoinRoutes clients were able to trade Bitcoin perps at the quote while saving significantly on exchange fees.

BTC-USDT.PERP.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2FMkWjQKUSn09k9wNH4XVrt%2Fbed9ca558a40b9a50dd216a21bcdac20%2F9_BTC-USDT.PERP.png)

Ethereum Performance

The first Ethereum chart shows performance of Ethereum orders in US Dollars over $1.7 billion in notional value traded over 1490 orders, for an average order size of over $1.14 million. We find it interesting that CoinRoutes performance with slippage of 7.4 basis points is better than large Bitcoin orders, despite Ethereum being widely cited as having only 30% of the liquidity of Bitcoin.

ETH-USD.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F3MMuD6TVDGJ1i5g0uVL6P1%2F3e646908096ea84376f7b2d913660670%2F10_ETH-USD.png)

Next, we show the performance of CoinRoutes algorithms on Ethereum traded in USDT. These orders experienced slippage of less than 3.1 basis points, on roughly $200 million in notional value. As Ethereum in USDT is one of the tightest spread markets, these numbers are not that surprising, due to the ability to capture bid offer spread without significant impact.

ETH-USDT.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F4aFmwz7I8ym4Ro85tpjAJb%2F725dbbd034a39cbcae0b1ed5229a3ca8%2F11_ETH-USDT.png)

Last, we show the performance on Ethereum perpetual swaps over $6.6 billion in notional value traded. With an average order size of $315k, slippage was under 6 basis points from the midpoint and under 2.8 basis points from the far side of the quote.

ETH-USDT.PERP.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F318m0dUxdbNvn9Lwosztwv%2F87e19295e33040274b9467606cd10b84%2F12_ETH-USDT.PERP.png)

Solana Performance

Solana spot trading is significantly less liquid¹⁰ and more volatile than Ethereum, and the performance metrics represent that, but the derivative markets are relatively more liquid than spot and that also shows up in the data.

The first chart, on $472 million in notional value traded with an average order size of roughly $680k, shows slippage vs the far side of just over 20 basis points. While that number seems large, if one adjusts for relative volume and the higher fee levels on those exchanges, it is a reasonable result.

SOL-USD.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F1oufIAwpK7Dp5PoJNnHJ1O%2Fedc82cf94e13ac6486c4ca78a32ddab8%2F13_SOL-USD.png)

Next, we show the performance of Solana vs USDT over $218 million in notional value traded. The slippage vs the Midprice was just over 17 basis points, which is in line with the USD denominated spot trading considering the order size of $390k.

SOL-USDT.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F5ru3Em6zC4eiyLrNBSMc2X%2F0880bd44fe45ab80a65698f93da7c5bc%2F14_SOL-USDT.png)

The last chart in this report displays the performance of Solana Perpetual swaps. With over $1.2 billion in notional value traded and an average order size of approximately $190k, the slippage was exceptional. The slippage amounted to 4.15 basis points relative to the mid-price and less than 1.2 basis points from the far side, indicating the robust performance of highly volatile swaps through the system.

SOL-USDT.PERP.png?u=https%3A%2F%2Fimages.ctfassets.net%2F3dkfueqvsbv6%2F7jKi1fgK6yCtUe51zFIRZ6%2Fe5c7ba67022302d3dffd6dae31fdf4cd%2F15_SOL-USDT.PERP.png)

Endnotes

¹ While performance was measured as positive versus this benchmark, the numbers were within a margin of error, so we consider it statistically zero.

² For the purpose of this analysis, constrained includes non marketable limit prices or aggression levels designed to be much more or less aggressive than either the aggressive or neutral settings.

³ Outliers are defined by either under or outperformance of over 5% relative to the benchmark.

⁴ Market data disruptions that are excluded are those orders where either quote or trade data was unavailable from the exchanges in use for the majority of the order.

⁵ Crossed markets describe a situation where the bid is higher than the offer. Note this can not occur on orders executed on single exchanges, such as for the majority of Perpetual Swap orders.

⁶ As opposed to the FX markets, where the most traded pairs are low volatility, have little variance in spread and are traded predominantly by interaction with dealer quotes.

⁷ Data provided by Larry Tabb, director of Market Structure Research for Bloomberg Intelligence from a paper written with Jackson Gutenplan.

⁸ Block: Meaning, Advantages, Trading Signals

⁹ Spread orders, were excluded from this analysis as they are subject to the constraints of the opposing side of the trade.

¹⁰ Roughly, according to CoinMarketCap, Solana spot trading volume is 1/7th that of Ethereum on an average day.